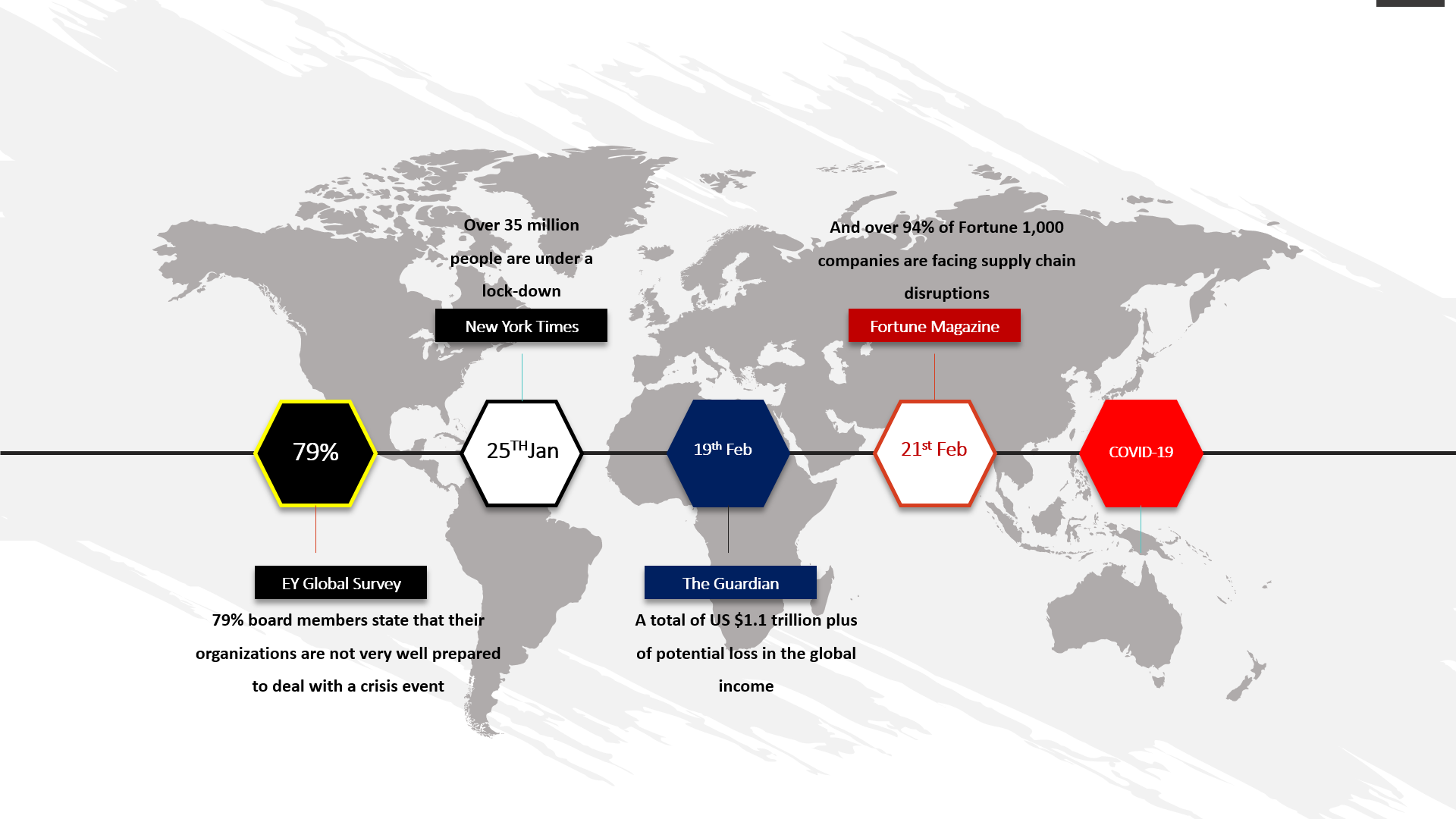

Coronavirus is trending on all social media platforms for a reason: it is the 21st Century Pandemic. Many of us are experiencing something like this for the first time. And it has tested the global economy preparedness for an outbreak.

According to the EY Board brief on the COVID-19,

According to the brief, “the outbreak of the Coronavirus Disease 2019 (COVID-19) has stricken communities across the globe. The virus’s rapid geographical spread has caught the world off-guard with major implications for personal health, business continuity and the world economic order.”

The EY Board alert addresses three questions:

This is a brief alert that you must read. Find a copy here, https://www.ey.com/en_gl/transactions/companies-can-reshape-results-and-plan-for-covid-19-recovery.

The alert identifies eight areas being affected:

Concerns over the health and safety of employees havecaused the suspension of theme parks, movie theaters, and other public entertainment venues.

Disruption in supplies, employee absenteeism, many companies is exposed to defaults on obligations. “Insurance companies are reporting a significant jump in business interruption and event cancellation claims”, the EY alert notes. Indeed, these times are not good for many businessesacross the globe considering the interconnected nature of the economies.

EY Board alert notes that falling production capabilities, increased shipment time, deferral customer purchases are putting significant stress on short term capital requirements.

Many industries – “aviation, retail, health, travel and other industries with front line consumer interactions are already reporting higher than usual employee absenteeism.” And that many companies have already enforced travel restrictions for their employees, the Alert notes. Even as organizations are encouraging remote working, organizational effectiveness and productivity are being affected.

“The International Air Transport Association has warned that the falling passenger demand could cost the industry over the US $29 billion in lost revenues this year.” And “that channel preferences are also getting impacted. Customers oriented towards traditional channels are opting for online banking and e-retail requiring companies to make immediate adjustments and extend transition support”, the brief notes.

Such adjustments risk straining organizational resources and could impact further on cash flows.

“Security monitoring centers in COVID-19 affected areas have been shut down, rendering several companies exposed. And that cybercriminals masquerading as WHO representatives are sending fake COVID-19 email updates to bait users and steal confidential information”, notes the EY 2020 Board Alert.

In times like these, the EY alert notes, “stakeholders look up to organizations to put people ahead of profits. Indeed, several non-life insurance companies operating in COVID-19 affected areas have enhanced benefits for those diagnosed with the virus.”

Some companies that operate just-in-time inventory with high reliance on a few vendors. These are now facing stock-outs due to closure of operations by suppliers. This is affecting the business.

The Alert recommends a three-phased approach to prepare – assess, respond and monitor. Conduct an assessment ofthe impact on your people, customers and suppliers, critical functions and legal and contractual liabilities as well as possible financial impact.

Make the right response. Are you applying a people-first mindset, focused on safety and wellbeing. Are you establishing a crisis command team that is empowered? And are you communicating with your stakeholders? And finally, monitor the impact of your response strategies.

To read the full paper, visit https://www.ey.com/en_gl/transactions/companies-can-reshape-results-and-plan-for-covid-19-recovery.

Copyright Mustapha B Mugisa, 2020. All rights reserved.