Most organizations don’t grow because they don’t change. They tweak processes, play with new products, or shift people around, but real transformation? Rare.

UGAFODE Microfinance Ltd, however, didn’t just grow, it tripled its size, doubled its loan book, expanded into refugee settlements, and became a leader in financial inclusion. And no, this didn’t happen because of luck or market conditions. It was engineered.

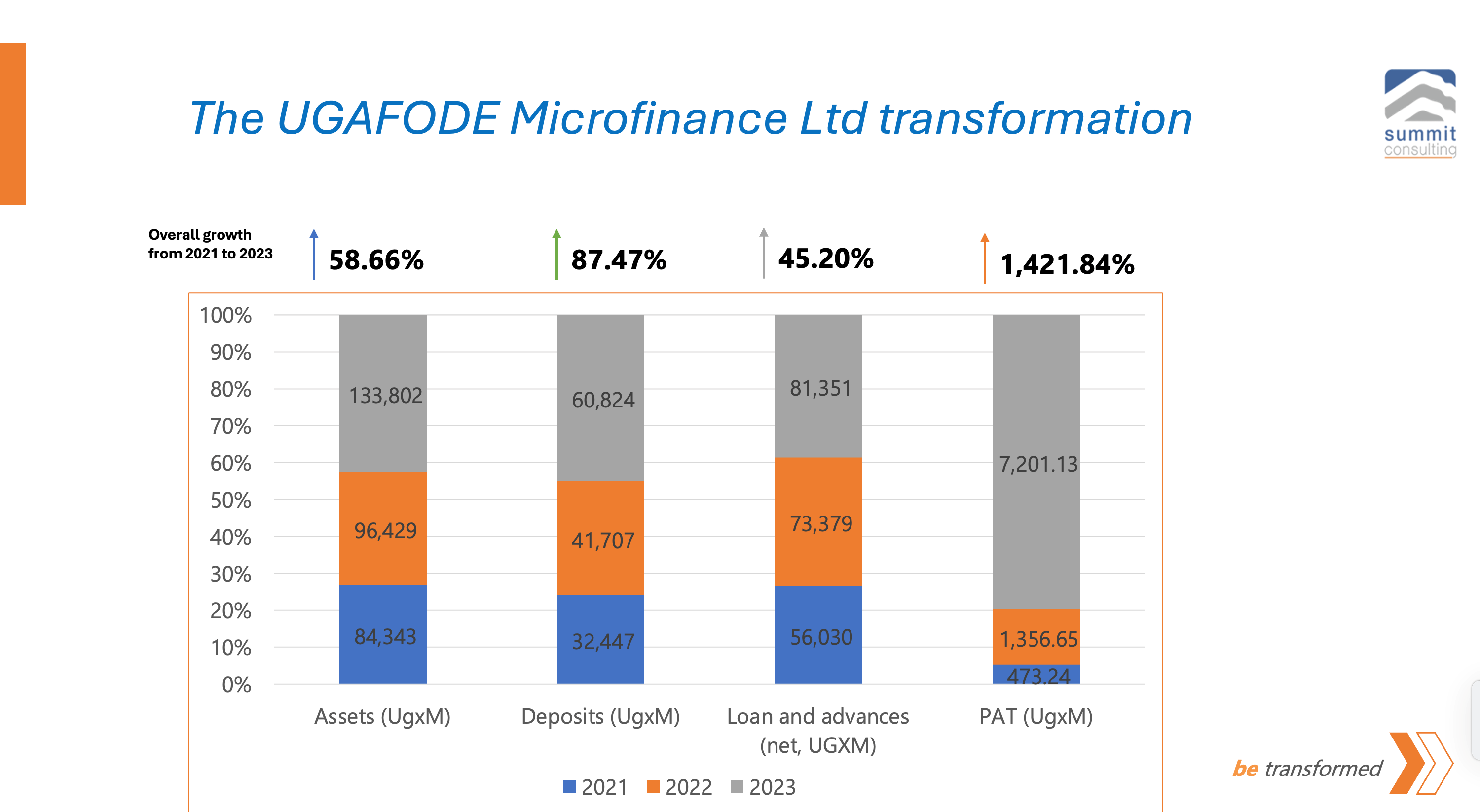

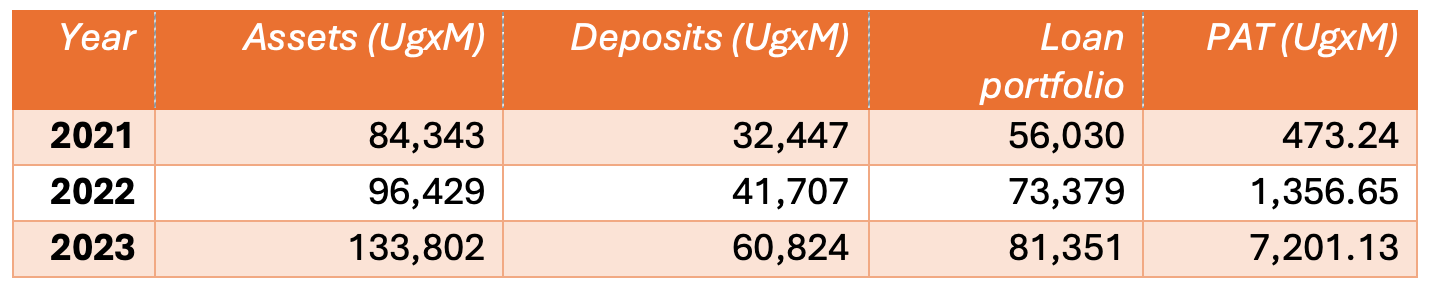

Back in 2021, UGAFODE was just a decent microfinance institution facing critical challenges. With UGX 84 billion in total assets, a loan portfolio of UGX 56 billion, and deposits at UGX 32 billion, most of which was fixed deposits, implying high cost of funds, growth was happening, but not at the pace or scale required to create industry leadership. The market was shifting, competition was heating up, and COVID-19 had left scars and uncertainties which demanded a new level of strategic thinking away from the usual talk of predictable KPIs, scorecards and such stories. More than ever, Ugafode needed more than just a strategy document, it needed a transformational game plan and leadership that could translate into bold action, not another round of corporate meetings producing forgettable PowerPoint slides.

That’s where Mr. Strategy (Mustapha B. Mugisa) of Summit Consulting Ltd stepped in. Our role? To make strategy real. To go beyond talk and guide leadership in making choices to win.

The engagement was not about delivering another strategic document; it was about empowering leadership to think and act strategically, ensuring that every decision aligned with the institution’s long-term vision and growth objectives. The focus was clear: move beyond reactive decision-making, embed a performance-driven culture, and unlock the full potential of the leadership team to drive execution at scale. We started with a board engagement, then engaged with management and carefully selected strategy champions, including facilitating town hall meetings to empower all staff, including frontline people, to think big-picture. This created ownership and clarity of focus.

Source: Audited Reports 2021, 2022, 2023

The impact of this collaboration speaks for itself.

By 2023, Ugafode’s total assets had surged to UGX 133.8 billion, its loan portfolio rose to UGX 81.4 billion, and customer deposits had nearly doubled to UGX 60.8 billion, driven by a higher current asset, savings assets (CASA) mix instead of highly priced Fixed Deposits which make access to finance difficult. This was a deliberate strategic move. Most significantly, profitability skyrocketed from UGX 473 million in 2021 to UGX 7.2 billion in 2023, reflecting stronger operational efficiency and financial sustainability.

But this transformation was not just about numbers, it was about market positioning, impact, and leadership. Ugafode expanded from 12 to over 20 branches, extending its footprint to 107 districts across Uganda. It also became a pioneer in financial inclusion, leading the way in refugee finance by establishing the first-ever microfinance branch inside a refugee settlement.

In brief, this is what changed…

- From playing safe to bold expansion: In 2021, Ugafode had 12 branches. Today? 20+ branches, 3 service centers, and presence in 107 districts.

- From good intentions to actual financial inclusion: It became the first microfinance bank in Uganda to operate in a refugee camp, serving 10,000+ refugees with tailored loans.

- From slow growth to a financial powerhouse:

- Loan portfolio – From UGX 56B (2021) → UGX 81.4B (2023)

- Customer deposits –UGX 32B → UGX 60.8B

- Total assets –UGX 84.3B → UGX 133.8B

- Net profit –Record-breaking UGX 5.28B in 2023

This isn’t magic.

It’s what happens when leadership commits to real change and brings in the right strategy partner.

At the core of this success is Shafi Nambobi, whose leadership ensured that strategy was not just a high-level discussion but a lived reality within the institution. When leadership is empowered to think and act strategically, transformation is inevitable. Shafi assembled the right team and brought in the best strategy expert – Mr Strategy. With the right strategic guidance, UGAFODE’s leadership team did not just manage change, they led it. They embraced a structured, execution-focused approach, making strategic clarity and decision-making the backbone of their operations. The result? A microfinance institution that is not only bigger and more profitable but also more resilient, efficient, and future-ready.

The Mr. Strategy effect

Most consultants will give you a strategy document. We gave UGAFODE a growth engine.

- We aligned leadership – clarity over confusion.

- We trained teams to execute – no excuses, just results.

- We built a strategy with actual impact – not just “more loans” but a smart approach to financial inclusion, profitability, and resilience.

Ugafode is now one of the fastest-growing financial institutions in Uganda. But here’s the truth: this could have gone the other way. Without a clear, execution-focused strategy, they’d be another MFI struggling to survive.

The lesson?

This journey reaffirms a critical business truth: growth is not about luck. It is about strategy. Organizations that work with the right strategy experts to equip their leadership with strategic thinking and execution discipline consistently outperform those that operate without structured guidance. Strategy alone does not drive results, leaders who are trained to execute it do.

Most businesses talk about change. Few commit. UGAFODE did and that’s why they are thriving.

Want real transformation? Let’s talk.

At Summit Consulting Ltd, we mean business. Think of your organization as a powerful car, but if you have dead spark plugs, misaligned tires, and leaking engine oil, no matter how hard you push the accelerator, you won’t get far. Our role? We assess what’s not working, identify challenges, and co-develop fixes as part of the change process while training your team to ensure effective execution and sustained performance. Want to experience real transformation? In the box Mr Strategy or contact us at www.summitcl.com.

#StrategyThatWorks #Transformation #Growth #Leadership