“Data is the new oil” goes the saying. But that is misleading. It does not matter the number of your oil reserves, if you lack the technology and skillset to drill, process and make it ready for use, your oil will be useless. Likewise, if you are not using your data to make informed decisions, your data is useless.

Your data is useless unless you have the capabilities to win with it. How do you use data to explore what is hidden in it? The summitBI data team provides leading-edge training and capacity building to empower you to win with data.

Do you want to make an instant impact in your organisation today? Come and attend the Certified Business Intelligence Data Analyst (CBIDA) Training at the SCL’s Institute of Forensics & ICT Security.

The course is very comprehensive and provides you with all the skills you need to become an instant hit in your organisation regardless of department. If you are a member of the Uganda Institute of Banking and Financial Services, you can enrol for this course at a discount. Take action today and get closer to your dreams.

Your managers and peers need insights from lots of data collected daily on their computers. Unstructured data contains a fortune only if one can use it in decision making. Unfortunately, many people are blind to it and make choices based on opinions and hearsay instead of facts, data and insights. And that is what the course offers you.

Business Intelligence and Data Analytics as a Service (BIDAaS)

If you want quality insights right away, we provide business intelligence and data analytics as a service. Instead of spending a fortune in setting up business intelligence and data analytics capabilities internally by investing in hardware or servers and software, you give us read-only access to your data and we set up an agent on your user machines to gain real-time insights.

The BIDAas Service rage

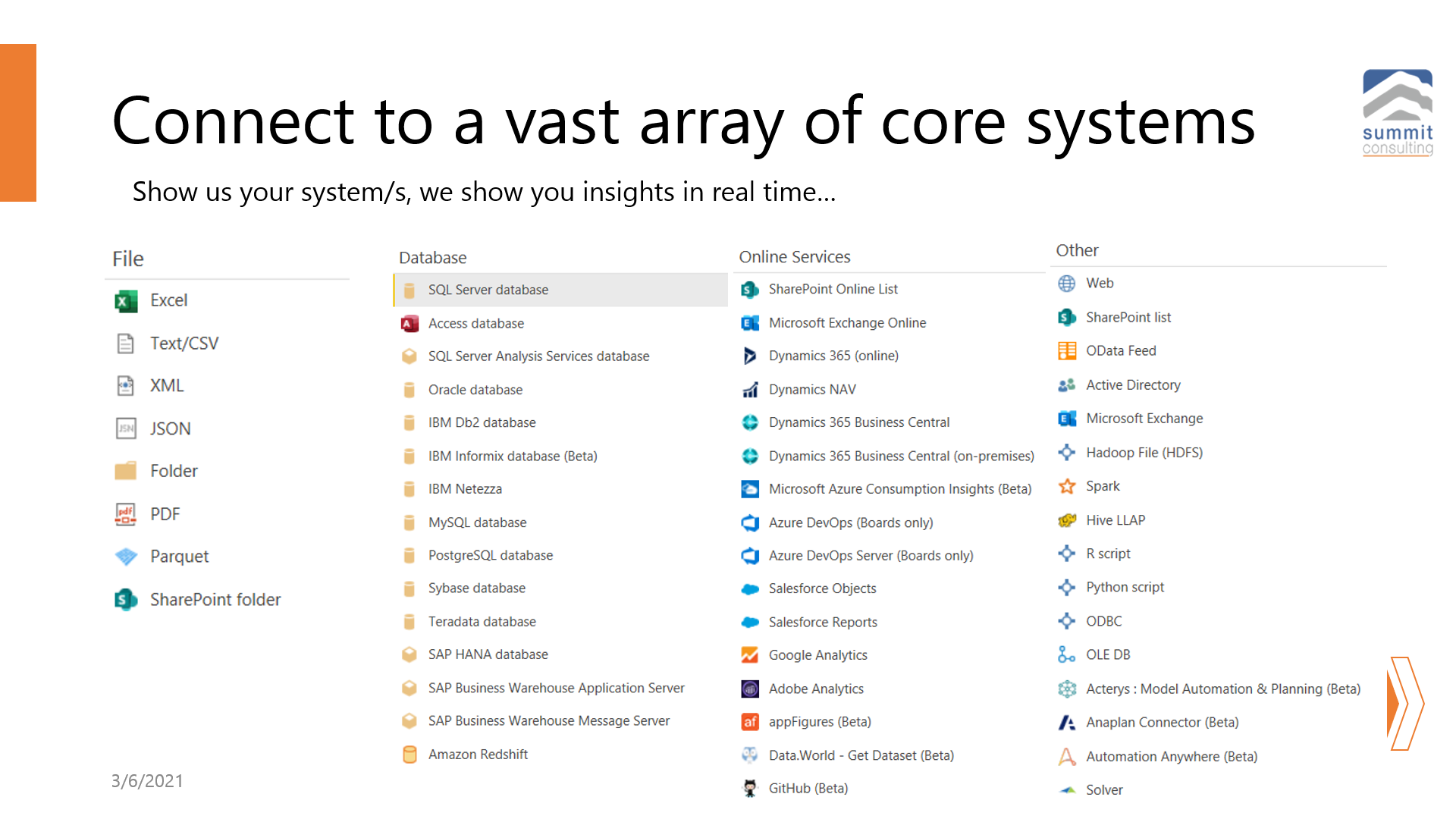

1.1 Connect to a vast array of core systems.

SummitBI analytics can connect to any core business application in your institution from the core banking system, ERPs, and other key operational applications used within your organisation. With this, users of SummitBI can unearth real-time insights from the system on a need-to-know basis. It does not matter where your data is (Figure 1), we have the skills and tools to clean it and get you insights to gain an edge over the competition.

Figure 1: summitBI systems we connect to and more…

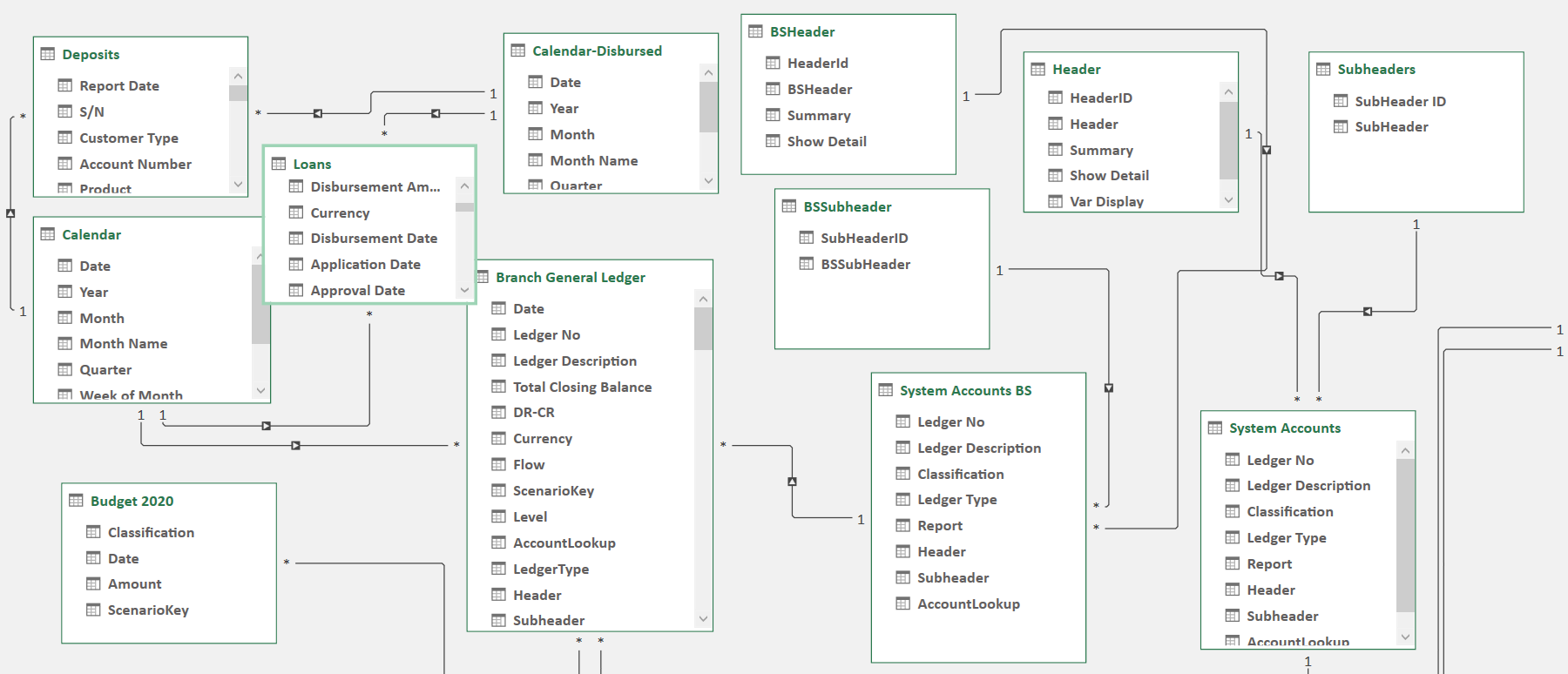

1.2 Automate your data modelling processes.

With the summitBI platform, we enable your most-used applications to automate the data integration process with real-time data modelling capabilities. This enables analysts to analyse across different perspective from related systems. All you need is to help us understand your structure, systems, and decisions you need to make from your data. We are therefore able to study your data sources, applications and databases and the data structure to know your data architecture and tables. We then create relationship maps to consider every possible insight that is relevant to your business. All these are done in the background by our data scientists and so you don’t have to get a headache looking at them.

Figure 2: Data modelling relationships

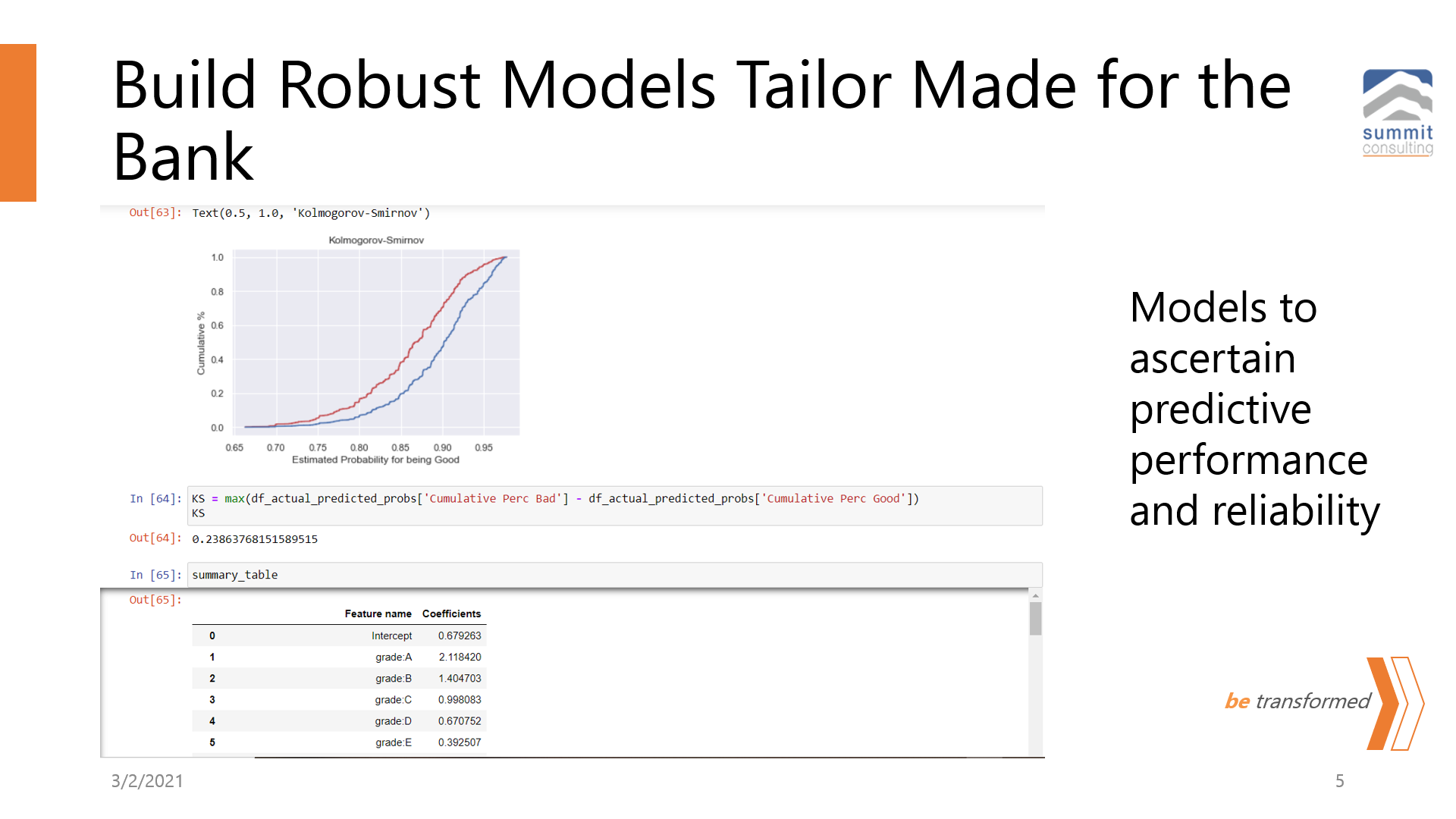

1.3 Build Robust Models Tailor-Made for your institution

SummitBI platforms enable the integration of currently used applications with robust machine learning languages like Python to develop robust predictive models with very accurate predictive power for forecasting key business operations like default, financial performance, investment decisions, absenteeism and other branch operations using tools that can only be accessed from complex computational tools and programs.

These models follow industrial best practice in forecasting expected losses and other key parameters with an accuracy of up to 98%. These also ensure real-time analytics and thus happen as the business operations occur. They work on a per-second basis.

Figure 3: Custom insights using python scripts

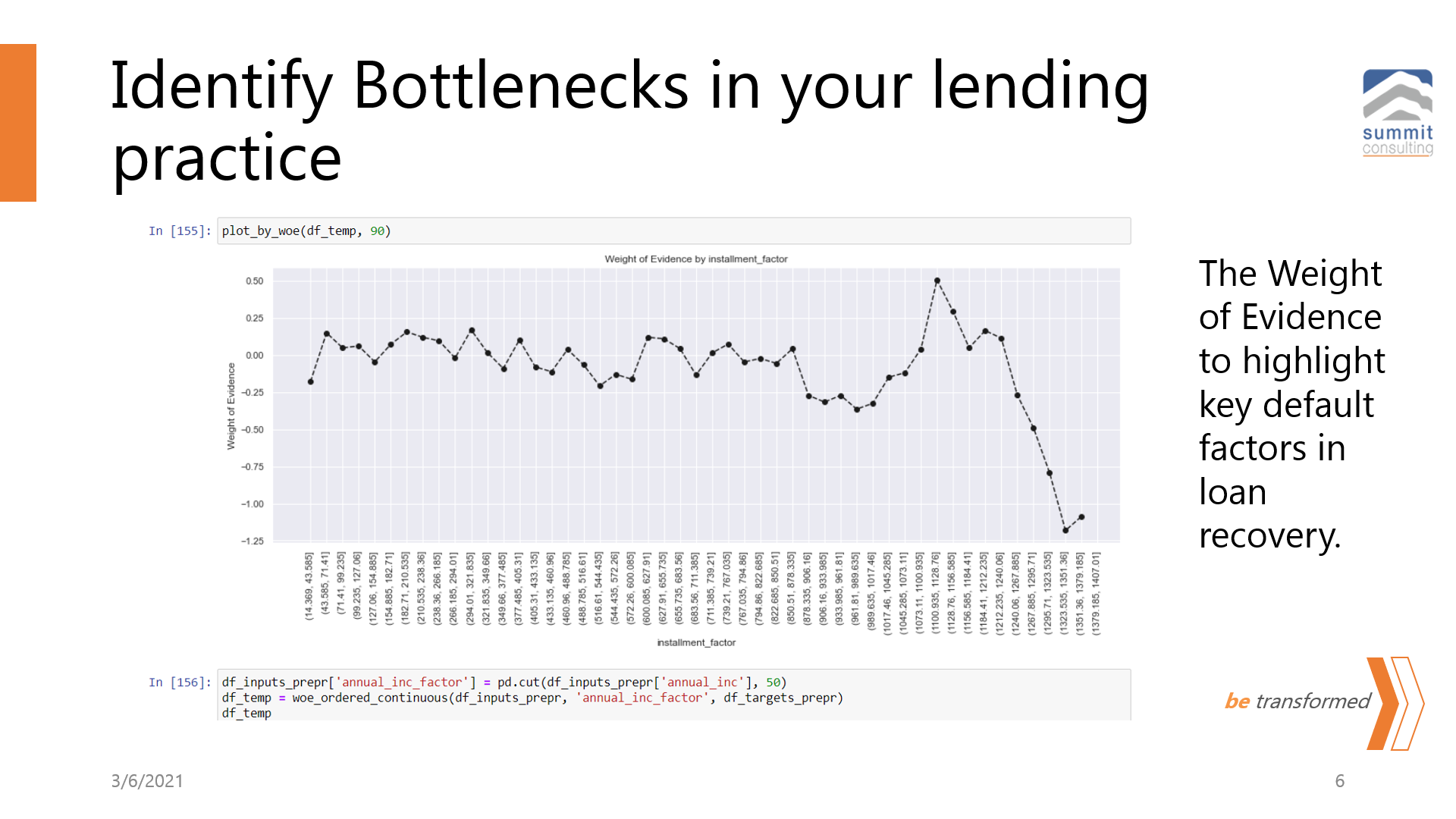

1.4 Identify Bottlenecks in your lending practice

These models use industrial accepted Financial Risk Management tools like Weight of Evidence to highlight the effect of each internal and external factor affecting borrowers, the financial institution, departments, employees and other key entities like markets and the economy at large.

The Weight of Evidence (WOE) is used by international banks and other institutions to select key model variables affecting creditor performance before running more complex diagnostic tests. This helps isolate useful and useless factors in predicting credit risk before running predictive models on them.

Figure 4: Weight of evidence modelling integrations

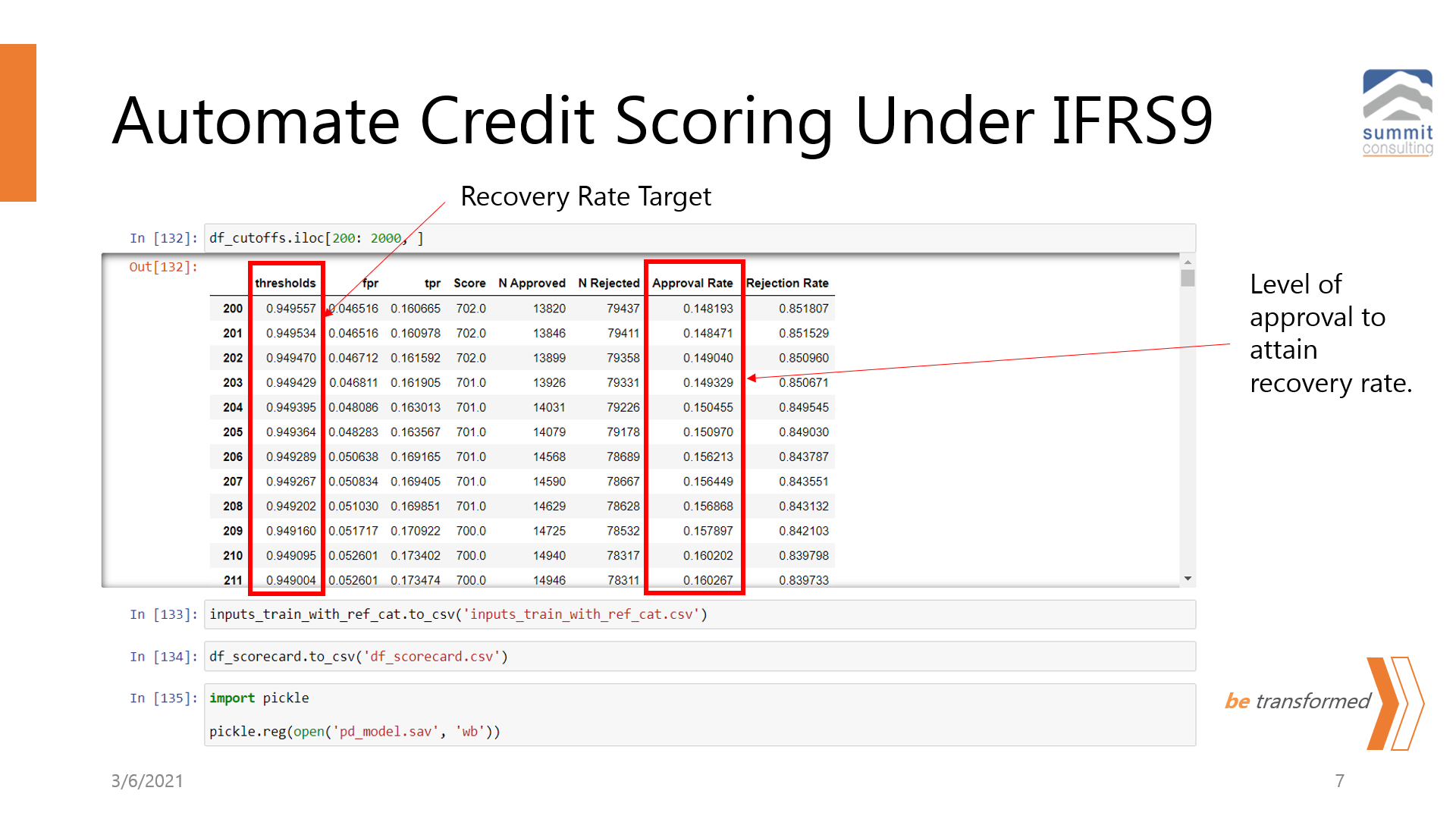

1.5 Automate Credit Scoring Under IFRS9

The models developed help EXCO and managers determine the level of lending they can handle at the lowest possible risk based on key internal and external factors.

SummitBI tool runs complex machine learning models like the Logistic Regression and Beta Regression to predict the probability of default for each client based on their historical behaviour. These computations happen at a predefined rate with data connections to the live sources of data.

These models are used to develop cut-offs that project loan recovery rates at different levels of loan approval based on the clients that have already borrowed. These rates help define the appetite the bank is willing to accept for a loss before it occurs which is a key element of IFRS9.

Figure 5: P IFRS 9 integration to reduce default risks

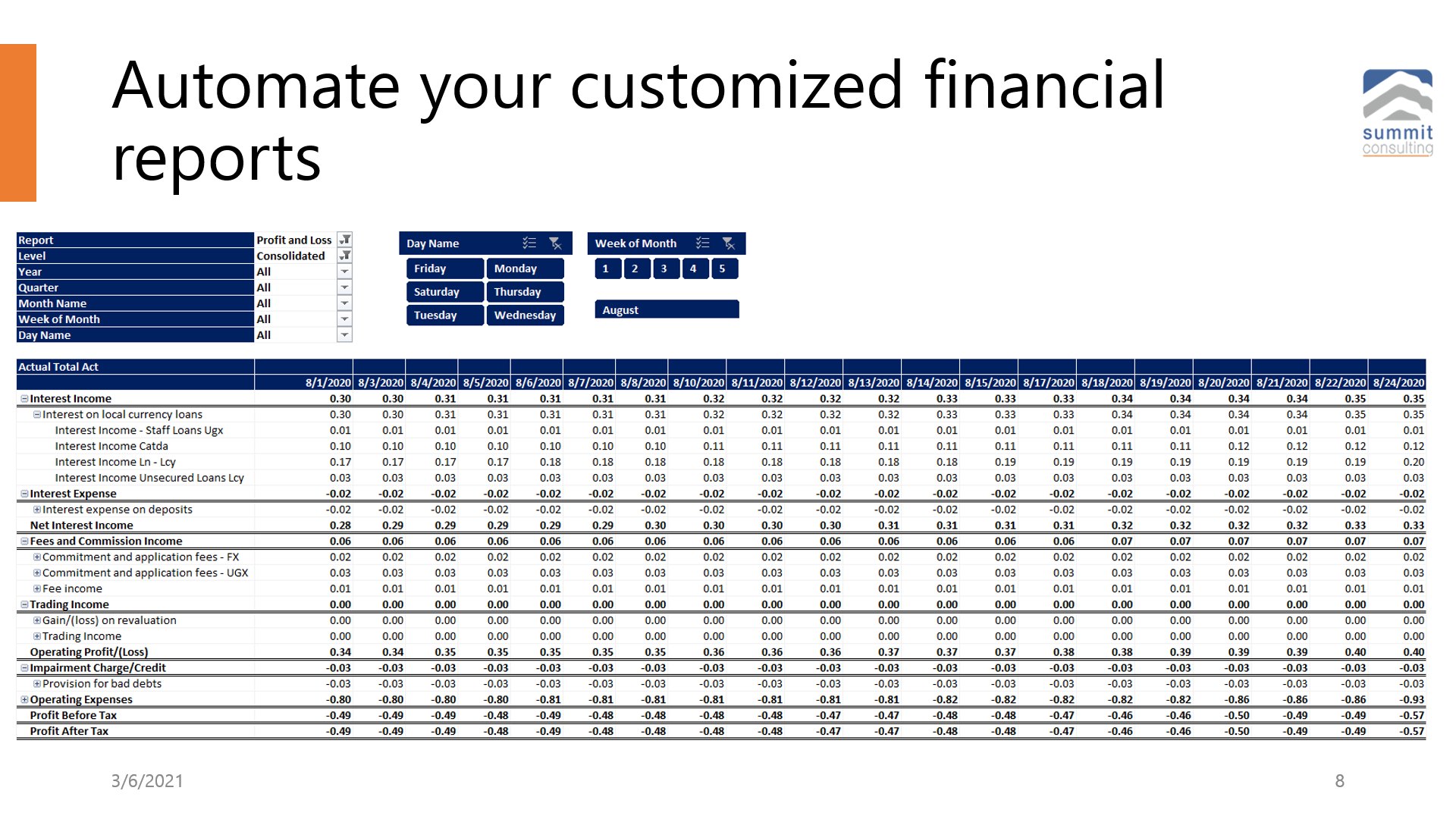

1.6 Automate your customized financial reports

SummtiBI tool enables finance managers and teams to automate compliance tasks like Financial Reporting based on IFRS9, BoU Guidelines. They process real-time reports with drill-down capability and analysis for each element in the report. This not only saves time but also clears space for other financial operations like decision making.

Figure 6: Automate your compliance reports

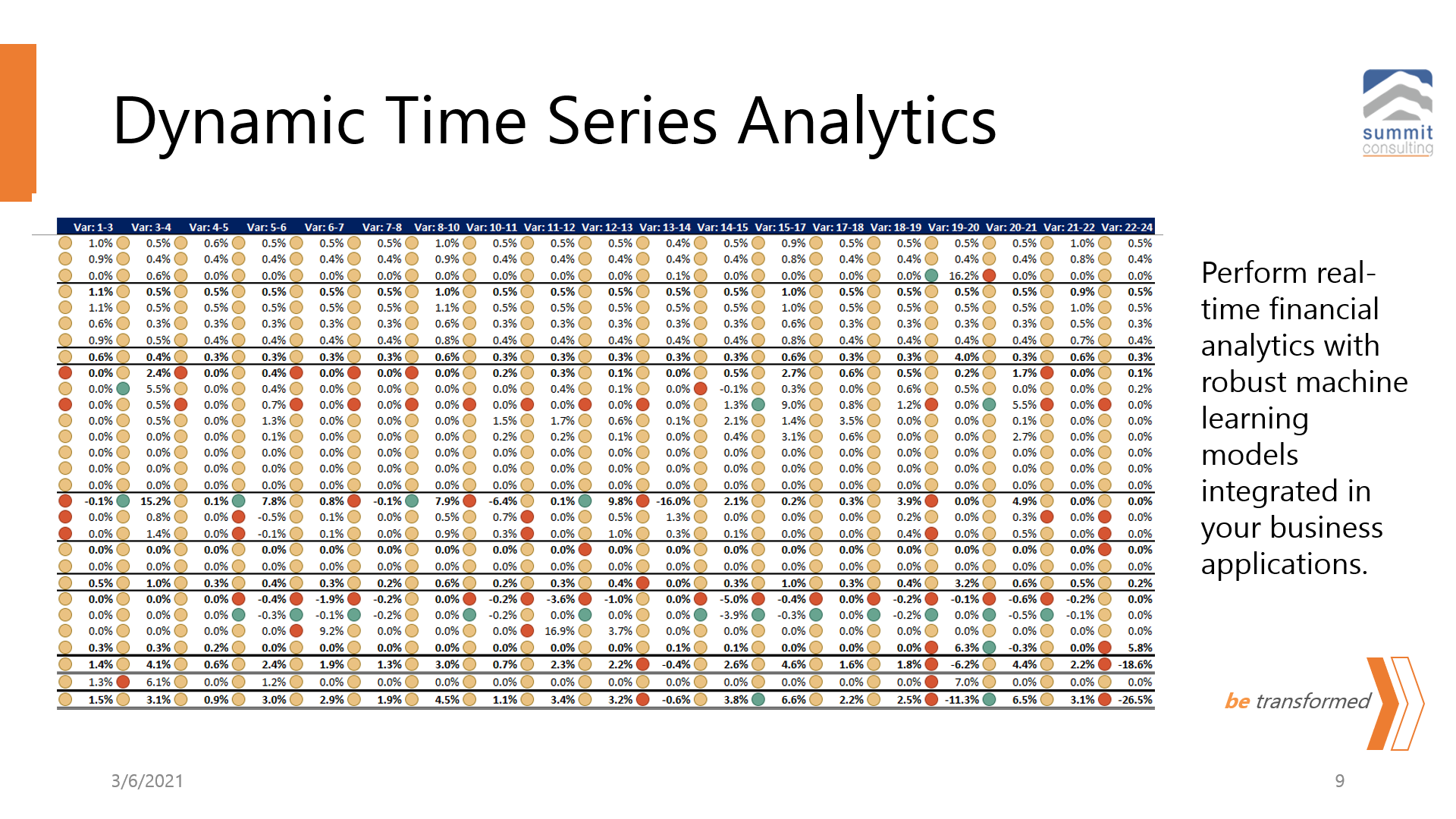

1.7 Dynamic Time Series Analytics

Our models provide real-time financial analysis of the financial data produced in the core systems to drive real-time decision making. This includes a CAMEL’S analysis, variance analysis and other key models for assessing bank performance at a click of the mouse. The analysis is further complemented with robust machine learning models to ensure forecast accuracy is maximized and decisions are made before they affect business performance adversely. As long as you have the data, and have clarity of what you are looking for in the data, we can build a custom code to deliver the insights you require instantly and display it in your favourite reporting tool – -MS Excel! Remember, all the analytics and business intelligence tools you currently spend a fortune to keep, report to Ms Excel or export to PDF! You can reduce your current budget of data analytics and business intelligence by over 70% and yet get more insights for your business needs in the short, medium and long term.

Just give us a challenge and tell us your decision needs and see the solution we have for you.

Figure 7: Get dynamic reports in real-time and gain an edge

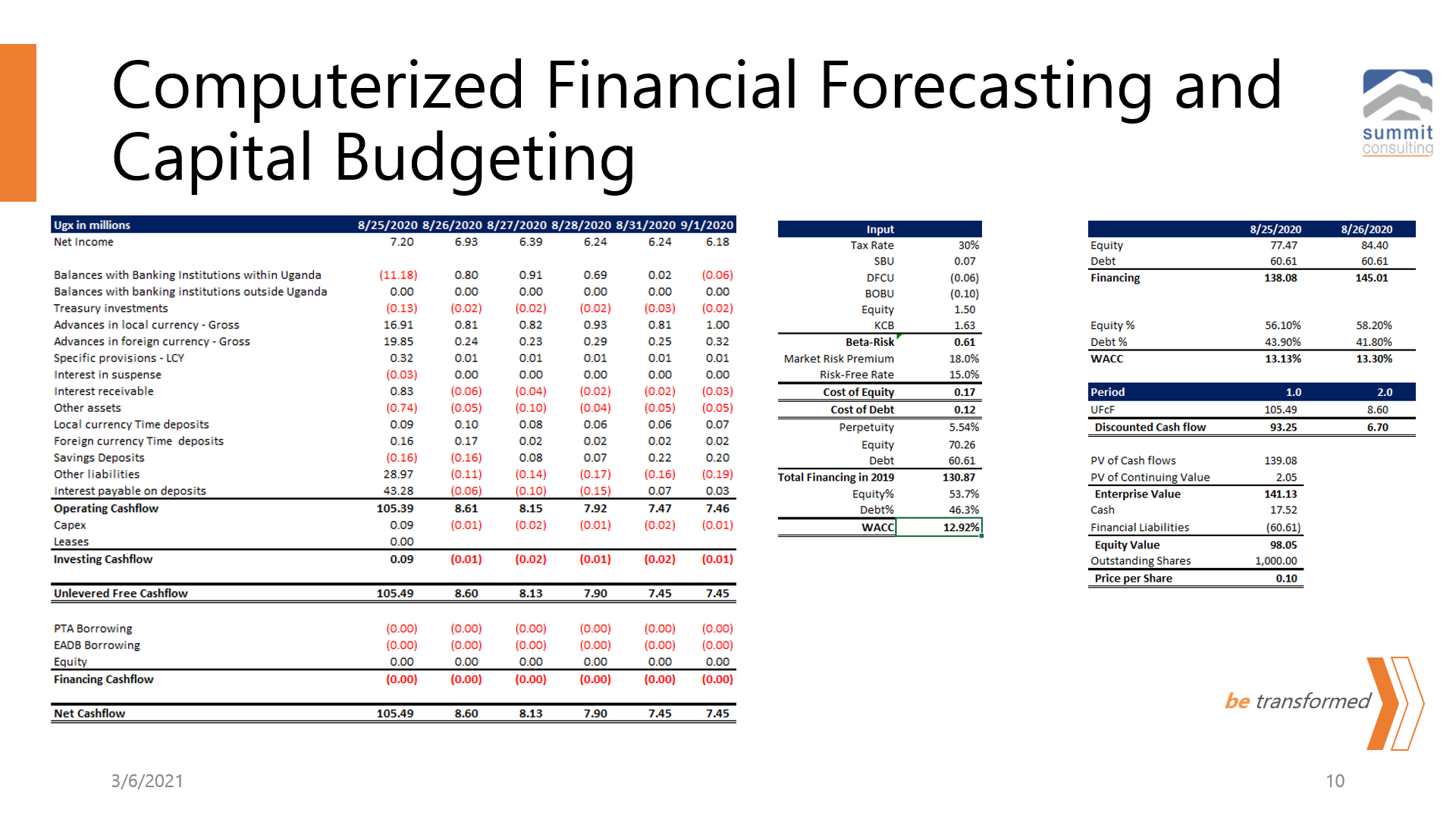

1.8 Computerized Financial Forecasting and Capital Budgeting

Our data models enable financiers to have real-time financial forecasting of the key financial aspects from performance, position to anticipated cashflows. These are driven by robust models from simple moving averages to robust multilinear regression models.

The tool also enables budget-actual analysis.

With the capital budgeting module, financiers are given time to concentrate more on giving the firm and shareholders value than on simple minor bottlenecks that will have been overcome with the predictive power in other modules.

Figure 8: Wow your partners and investors with a dynamic valuation model

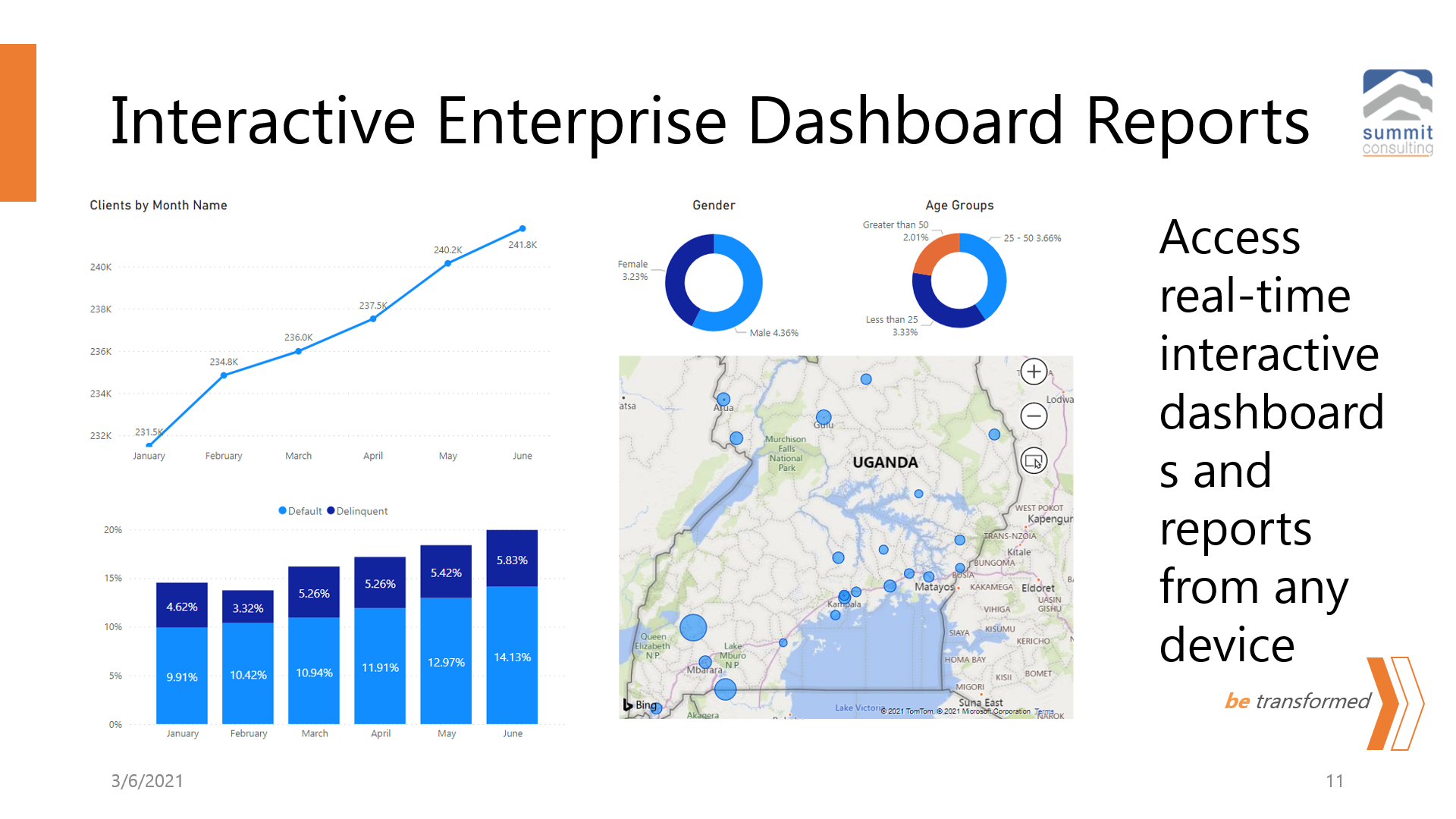

1.9 Interactive Enterprise Dashboard Reports

SummitBI tool ensures EXCO, boards and other supervisory teams receive real-time dashboard and reports on financial performance and expected performances in key departmental operations to drive decision making and keep your organisation afloat.

The reports are enterprise-wide and can be accessed on any device from desktops and laptops to mobile devices at points of convenience to keep the decision-makers awake.

Figure 9: Interactive dashboard to provide hard to find insights

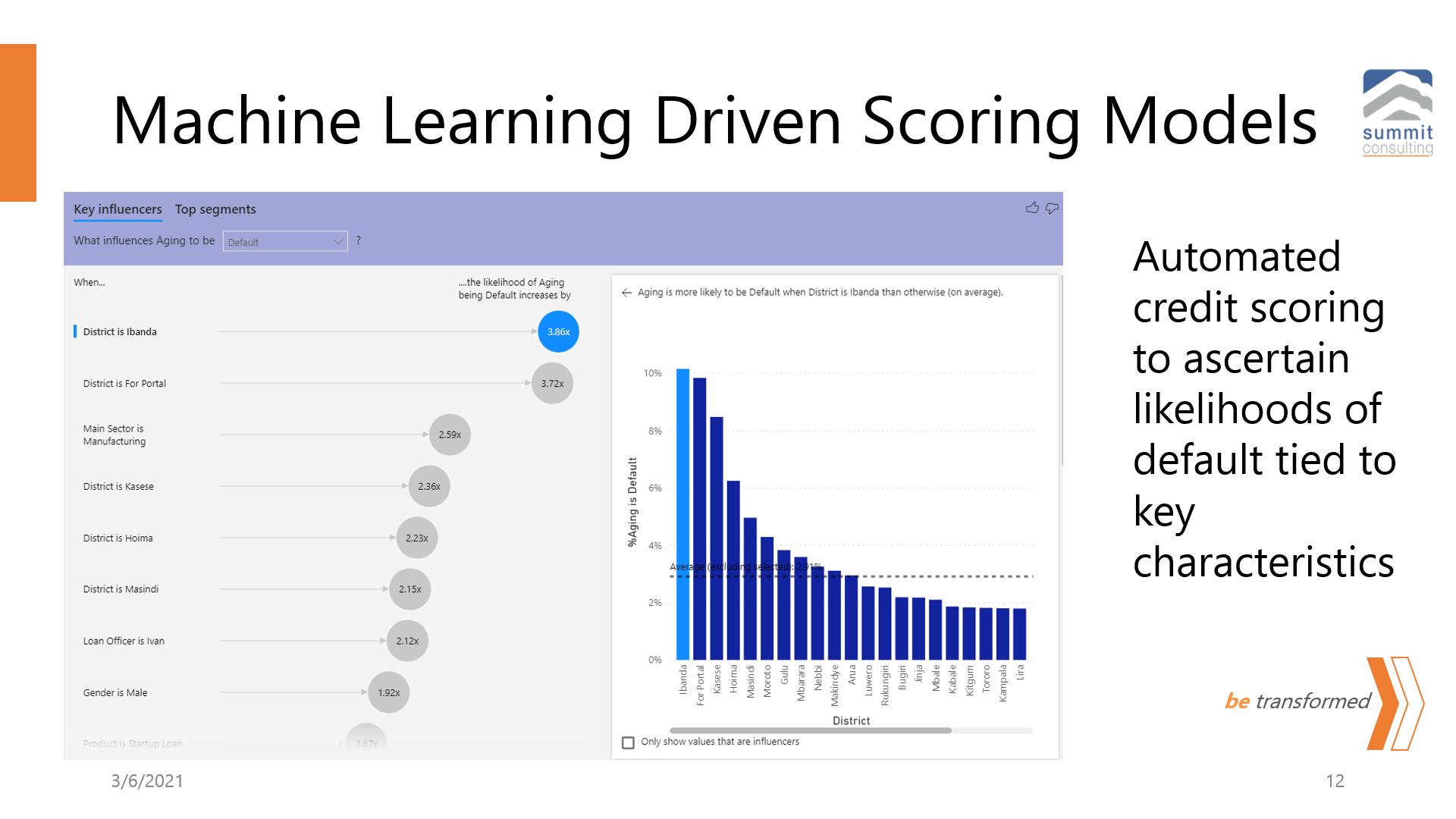

1.10 Machine Learning-Driven Scoring Models

SummtiBI platform integrates robust machine learning to the models developed to have a real-time assessment of key default factors and areas that need to be tackled during the credit life cycle to minimize NPAs.

These scoring models/scorecards can be used to perform real-time credit assessment of loan applications that do either accept or reject depending on the risk exposure to the borrower. These follow industrial accepted credit scoring models under IFRS9 used by FICO and Moody’s to assess and predict credit risk.

Figure 10: Machine learning models to uncover trends

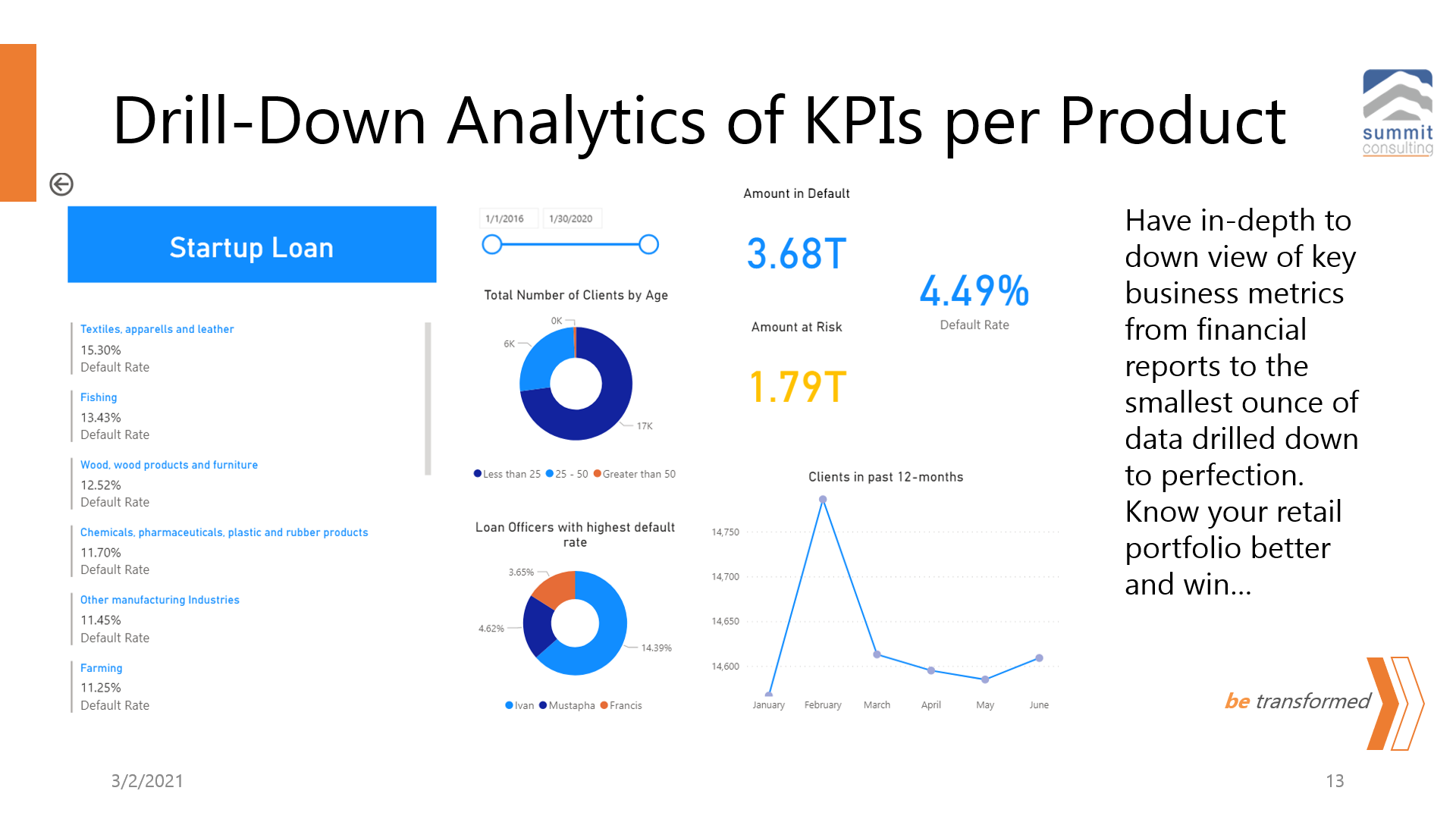

1.11 Drill-Down Analytics of KPIs per Product

The summitBI tool enables decision-makers to drill down to the lowest level of detail of specific loan products, clients and departments to expose hidden bottlenecks, key insights and ripe areas to leverage from using simple click and drag mechanisms that any user at any level of computer know-how can understand.

The more you know, the better. Get to the smallest cause and effect, and solve problems at the root, not at the surface. As an EXCO member, gain quick insights and stay a step ahead of the competition. Our summitBI tool integrates several open source solutions, including MS Excel, Python, and so many more as well as PowerBI to deliver outstanding insights that speak to your business.

Figure 11: drill down to the smallest details

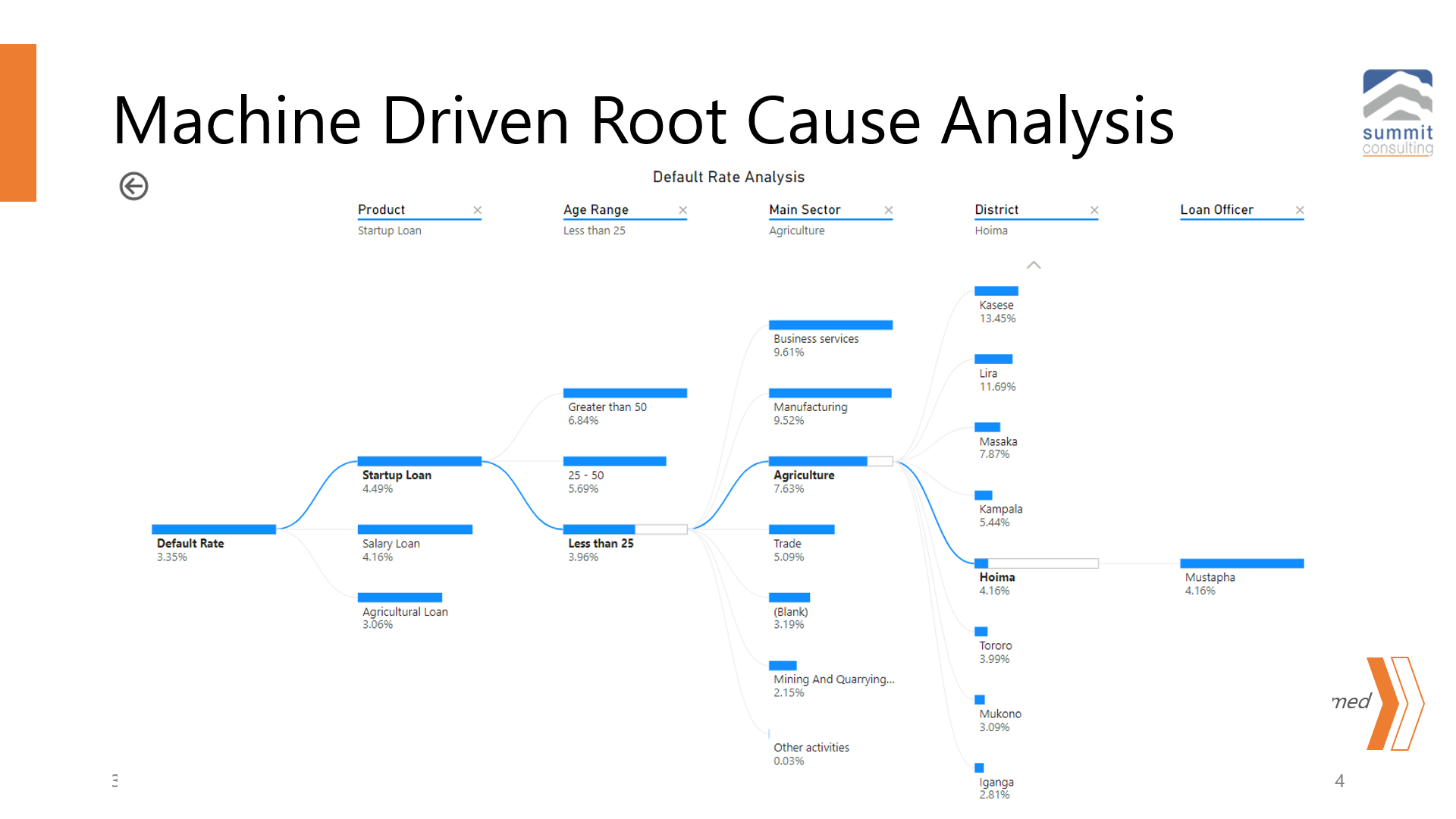

1.12 Machine Driven Root Cause Analysis

The application runs machine models to identify possible root-causes in key business operational bottlenecks in the system. Get the power of business intelligence and win.

We will understand your business and deliver insights in full colour you have never seen before.

Figure 12: root cause analysis.

Do you want to win? Whether you need practical data science training, or business intelligence as a service, contact us today.

Copyright Mustapha B Mugisa, Mr Strategy and Francis Xavier Mukembo, Mr Data, 2021. All rights reserved.