In March 2024, I received a call from a Nigerian bank, one of those institutions parading itself as digital-first while secretly running on analog thinking.

They wanted virtual training on credit risk management, a noble request. I welcomed the opportunity with open hands-on condition that I gained context about their business model and banking philosophy. They nodded yes. As I dug into their strategy and risk appetite, the contradiction was glaring: they were talking cloud, AI, and fintech partnerships on their website… but inside, they were still underwriting like it’s 1995.

Their loan officers were rewarded for paperwork. Their risk team still worshipped the 5Cs like a holy doctrine. You know the ones: Character, Capacity, Capital, Collateral, and Conditions. A framework so outdated it should come with a fax machine. All their credit officers were masters of this old-fashioned credit assessment model!

The result? A bank that talks scale but lends slowly. One that dreams of entrepreneurial clients, but punishes them for lacking land titles. Mismatched lending. Stagnant growth. Poor credit outcomes.

That’s when I introduced them to a different path.

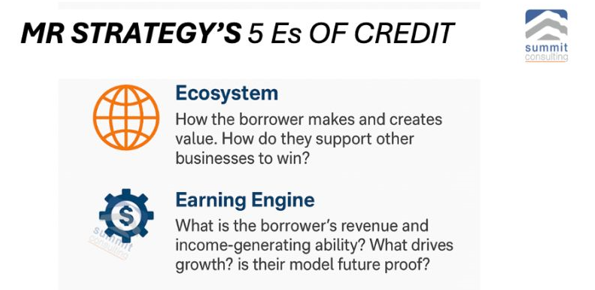

A bold, rule-breaking, and data-aware lens I’ve developed over years of advising modern times-ready banks across Africa, Mr. Strategy’s 5 Es of Credit. Not based on hope. Not based on tradition. But built for the digital entrepreneur, the mobile-first trader, the informal hustler who generates value daily, even if the bank has never heard of them.

“You’re already dead if your bank can’t underwrite a TikTok entrepreneur.”

The 5 Es is a strategic reset.

Where:

a) Ecosystem replaces isolation. It asks: Who does this borrower help win?

b) Earning Engine demands proof of present value, not historical noise.

c) Engagement Behavior decodes trust by studying digital presence and responsiveness.

d) Elasticity measures adaptability and scale potential, not sunk capital.

e) And Ethical Signal finds compliance and integrity in online reputation, not just paperwork.

If you’re a bank executive still making policies and evaluating today’s and tomorrow’s borrowers with colonial-era tools and a mindset, the future isn’t your problem; irrelevance is.

The 5 Es model is how winning banks lend today. Everyone else is just writing off yesterday’s loans.

Welcome to modern lending.

A boda rider with a 4.8-star rating on SafeBoda, who repays airtime loans and pays rent via mobile money that’s a better borrower than a suit with a fancy proposal but zero digital trail. Banks must stop demanding collateral in a world where data is collateral. The old model rewards privilege. The new one rewards performance.

You’re already dead if your bank can’t underwrite a TikTok entrepreneur. I can help you rebuild your credit system before it breaks you. Need a detailed write-up of the 5Es of modern bank lending? In the box for a professional engagement.