Transparency is the best business. And no one can talk about good governance without transparency. To this end, banks in Uganda are required to publish their audited financial statements within four months after the end of the financial year i.e. by 30th April of the following year. Detailed publication of the key information about the performance of the business over the past 12 months and the statement of the financial position as at the year-end helps stakeholders make informed decisions.

During quarter one of 2020, many banks published their audited financial statements in compliance with the regulatory provisions. Some banks reported losses attributed to increased provisioning for bad and doubtful debts. In this article, I shine a spotlight on United Bank for Africa (UBA), with headquarters in Nigeria, which started operations in Uganda in the second quarter of 2008, bringing the total number of banks in Uganda to 17 at the time. For a detailed Uganda Banking Sector Report 2020, inbox to me your email.

The facts

- United Bank for Africa reported operating losses every year over eight (8) years period since 2008 thereby posting accumulated losses more than Ugx. 48,658,609,000 (Figure 2), until it changed her business model around 2017.

- As reported in the bank’s published audited financial statements of 2019, the bank’s accumulated losses now stand at Ugx. 40,616,488,000 in 2019.

- In FY 2018, the bank made a profit of Ugx. 4,908,454,000. In the FY ended 2019, the bank reported a profit after tax of Ugx. 8,054,201,000.

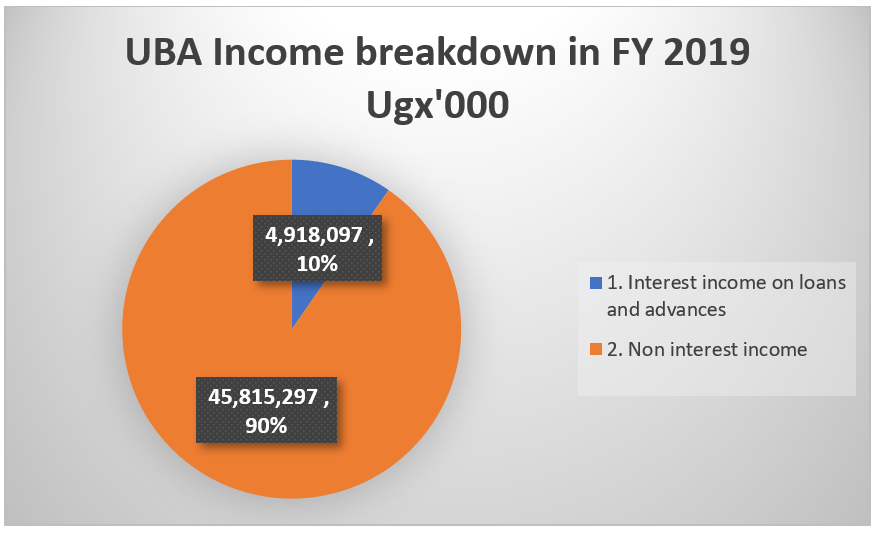

- Over 90% of the bank’s income in 2019 and 2018 came from non-interest income products (See Figure 2). Interest income (or income from loans and advances) accounted for just 10%! This means the bank is not helping business grow per see.

- The bank has a poor income mix that is susceptible to regulatory risks (Figure 1) since over 90% of its income is from investment revenue as opposed to loans and advances, which could indicate possible mission drift! See Figure 2.

- Whereas UBA reported the lowest provision for bad and doubtful debts at just Ugx. 139m in 2019, it recorded huge costs at Ugx. 33 billion lamped under “operating expenses.” These costs must be opened since they are material. See Figure 4.

Figure 1: UBA sensitivity heat map.

Figure 1 shows that UBA has a high cost to income ratio at 82.% and a very high non-interest income to total income ratio, at 90.3%! These figures at extremely compared to a desirable ratio between 25% to 45% for the cost to income, and less than 55% for non-interest income total income. Why does the bank report high operating costs when it earns from mostly non-risk products?

Figure 2: Interest income vs non-interest income

The above charts show the bank’s revenue split. Interest income means the bank gave out loans to individuals or entrepreneurs involved in some form of ‘bankable’ economic activities. A bank that earns a lot from interest on loans and advances means it is supporting the economy through giving performing loans to businesses that provide employment opportunities and help increase people’s incomes which taken together translate into economic growth. Non-interest income, on the other hand, means the bank is not giving out loans, but earning from bank charges, transaction fees, securities investments which do not help increase employment opportunities.

Figure 3: UBA income breakdown.

My take and key insights

- In 2017, UBA changed her business model from a loan dominated portfolio to an investment dominated one. The bank shifted its strategic focus from concentrating on loan disbursement to investing heavily in securities and fixed deposits (FDs). This has paid off heavily as it requires low operating costs with low risks of default. But is this model good for the bank or the economy?

- The regulator must take a keen interest in the portfolio mix for financial institutions to prevent the risk of ‘economic leakage’, where financial institutions that are supposed to provide affordable finance to enterprises end up concentrating in securities and money markets which should be a business for fund managers and stockbrokers – you get the picture. Just imagine a Tier I bank concentrating over 90% of its portfolio in securities investments. In the end, there is no liquidity in the market for giving loans, which make getting a loan more expensive for business financing, as banks focus on securities market at the expense of business financing.

- The Bank of Uganda should consider setting a limit of the maximum non-interest incomes banks can generate to qualify for a ‘banking license’ which has a primary objective of intermediation by mobilizing deposits from those with it and lending it to entrepreneurs who need it most at a profit, which in the process spurs economic growth.

- Any costs that are more than 30% of revenue, should be broken down when reporting to avoid material misrepresentations of the key cost drivers or inefficiency areas. Look at Figure 4, line 5 from the bottom!

- And to you the reader: would you call a financial institution whose 90% of the income comes from investment in securities a financial institution or a money dealer? What are the criteria for a bank to qualify into tier 2, in terms of outcomes (performing loans portfolio) of that bank NOT the input (minimum capital requirements)?

When we were young, our parents often reminded us “never to eat the seeds.” Once you ate the seeds, you had nothing to plant. Yet, the increasing shift to non-interest incomes by financial institutions is akin to “eating the seeds” as the much-needed cash is not availed to businesses to operate. The regulator must take a keen interest in such business models so as not to stagnate the economy. Banks must extend business loans as their primary business. And that means supporting entrepreneurs not only with loans but also offering the essential governance and leadership support they need to thrive.

PS: Since 2017, at Summit Consulting Ltd (summitcl.com), we publish the summitBI banking sector intelligence report (SBIR) based on the published financial statements. To be the first to receive the SBIR 2020, inbox your email or comment below. For prior reports, visit www.summitcl.com or contact me via any contact points on this website.

UBA Published Statements, 2019.

Figure 4: UBA’s 2019 published audited accounts, statement of financial performance.

Figure 5: UBA’s 2019 published audited accounts, statement of financial position.

Copyright Mustapha B Mugisa, 2020. All rights reserved.