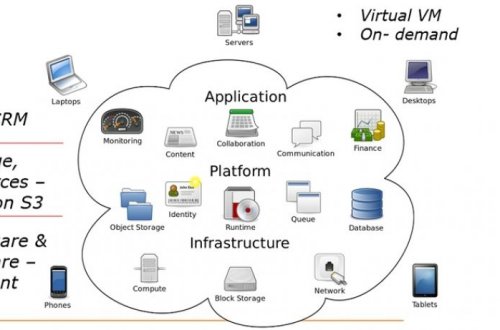

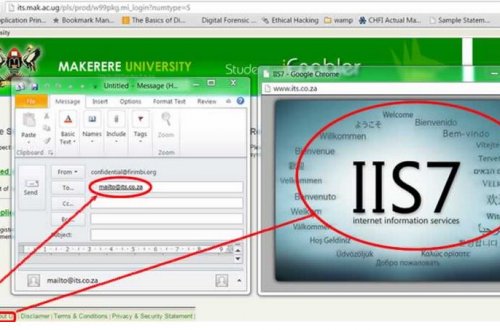

This is a summary of my presentation to bank CEOs at an event organized by the Uganda Bankers Association onFriday 11th October 2013, at Sheraton Hotel. To download the presentation, click here. The rate of fraud in Uganda’s financial institution is on the increase. Just like any industry, communication (or transfer of data and voice) is at the center of the success of banking business. Banking business processes are highly automated, with technology as a critical success factor. All the communication media are at risk – email, chat, wire transfer, web, phone, sms, payment platforms via http and https, fax,…

Loan fraud in a bank, part 2: here is how internal staff loan fraud was uncovered

Continued from part 1. Just to recap part 1, loan officers in a bank created fictitious loan applications, got the loans and withdrew the money. This kind of scheme involving “stealing in small amounts, over a long period of time” is usually difficult to discover. Before we get to how we uncovered it, here is more background This fictitious loan fraud was so good that it would have continued, had it not been for a disgruntled whistleblower, who had been part of the scheme but later left the company. Of the 12 people in the credit department, four knew about…