The biggest problem in Uganda is the tendency to recognize foreigners at the expense of locals who are educated. Makerere University (MAK) is a globally recognized institution ranked 9th in Africa. That is no mean achievement. Local Ugandans operate it and train so many people in the region every year. Some time back the Minister of State for Works was quoted during a conference as saying that “Ugandan contractors cannot undertake big road construction projects because they are incompetent.” Before making such a comment, one needs to understand that Ugandans are very competent and hardworking. The problem is they are…

Count down: One day to the summitBI® Banking Sector Report Launch on 14th August 2020

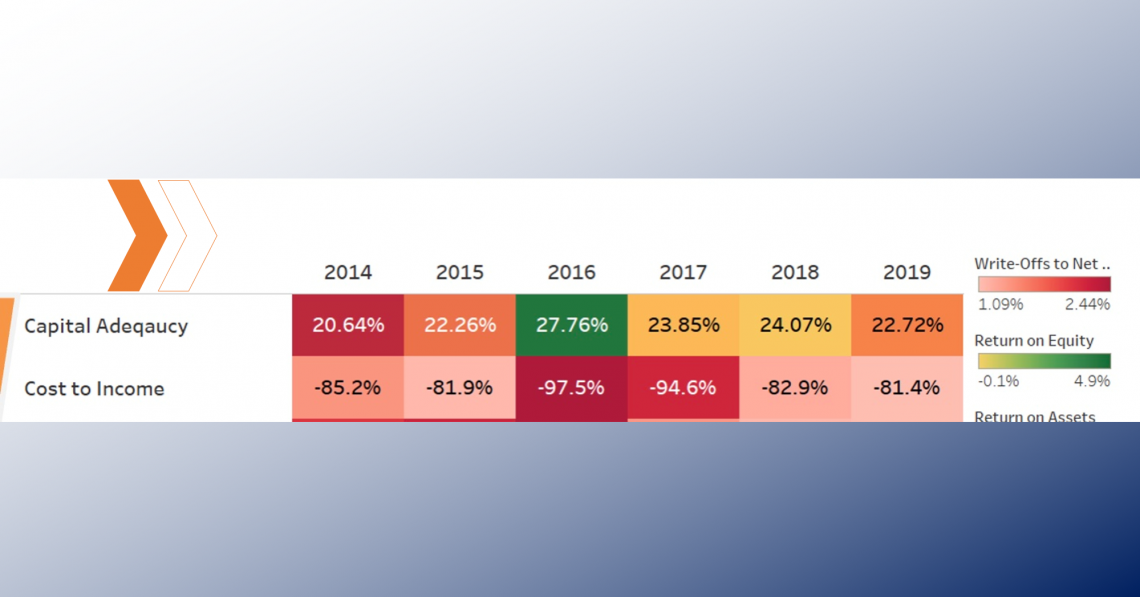

The summitBI® Banking Report contains a rare depth and analysis style as it is meant for a tactical and strategic user. It examines the domestic macro-financial environment with a focus on the performance and financial stability of each bank and the sector, against the CAMELS framework. Guided by the appreciation of the report’s readers and to further deliver the most comprehensive analysis of the banking sector, we have deployed Summit’s indices to bring out the true status of the Banking Sector. Below is the key findings from our analysis in this year’s summitBI® Banking Report 2020: study figure 1 carefully:…

The success blindfold: How should companies build resilience?

Reading today’s (10th August 2020) Daily Monitor, page 36, left me with a sour mouth. Why are many businesses defaulting on bank loans? What is the work of the banks’ credit risk assessment before a facility is given? How come banks give loans with more emphasis on the value of the collateral at the expense of quality of the business model and its potential success? Banks must invest more in risk assessment and review of the business models of prospective borrowers. Many young entrepreneurs have been turned down because they lack the much-needed collateral for that essential seed capital…

MTN’s five years to 2022 BRIGHT strategy explained

You have probably seen an MTN advert or you are an MTN customer? Do you know the MTN game plan? What does it mean to you as a customer or stakeholder? We took a few minutes to explore the MTN 5-year strategy, 2018 to 2022, to examine choices made, where to focus, and how to win. As a technology player, MTN reduced the planning period to just 5 years to underscore the everchanging telecoms environment. Take note that we know the confidentiality of companies’ strategic plans. This article is based on the MTN Group BRIGHT strategy briefing to shareholders which…

MTN Group is exiting UAE: ‘Africa is where our heart is.’

Africa may be disorganized or least developing, but it offers several market opportunities with cannot easily be found in other markets like in Europe, Asia, or the Middle East. In Africa, you can sell an average-standard product at a high-profit margin, and no one will care. Because in Africa, no one cares really! Consumer protection is weak. Customer awareness of their rights is weak, too. Many people lack an understanding of what a genuinely excellent service is. Any basic service offering is seen as excellent service. Take the case of banking. Many people are easily satisfied when they visit their…

Why a high cost to income ratio in banks?

#mindspark #banking Uganda’s banking industry is characterized by a high cost to income ratio. In 2016, during the election period, it peaked at an average of 97.5%, meaning a gross profit margin of just 2.5%! Being dominated by foreign banks, profits are repatriated through transfer pricing, high expatriate staff salaries and benefits, and generally high cost of capital from head offices… etc. Above all, many banks automation is not optimized. ICT is not an efficient driver but a cost driver making banking experience expensive. And of course, fraud costs reported as expenses! On 14th August 2020, we launch the banking…