Reference is made to the article “Police Officers must declare wealth” in The Daily Monitor of January 30, 2014. Since its enactment in 2002, The Leadership Code Act (LCA) has not helped address the high levels of fraud and corruption in the country. The IGG needs more financial support for its effective implementation. The problem with the IGP’s probe team is that it is ad hoc and may not be sustainable. Declaring wealth would work if the IGG (mandated to implement the LCA) had a robust and secure computerized system, readily accessible to all leaders to upload/ update their wealth at…

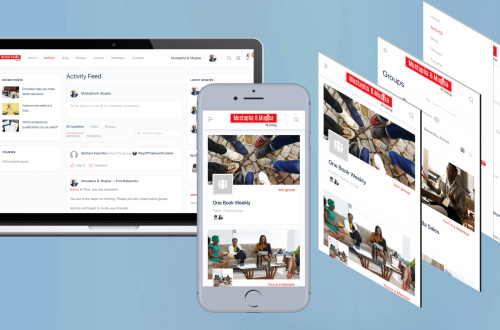

Hackers on a rampage, bank fraud on the rise! F

As banks try to make their services convenient through adoption of mobile technologies and internet banking, hackers are smiling. It is the time to harvest. The good news is that you don’t have to be tech savvy to hack into any financial institution. Banks are more interested in buying state-of-art banking applications, firewalls and other security mechanisms at the expense of training their staff in basic computer security and how to be safe while on-line. This article is an eye opener. With increasing high staff turnover in financial institutions, the risk of hacking is on the rise. New and existing…

Corporate governance, part 2 of 3: the telltale signs of a Board from hell

Before you proceed, read part 1 here. How do you tell your Board is one from hell? Below are 10 telltale signs of a dysfunctional Board of Directors. #10 Being on the BOD is an honor NOT an obligation. Do your board members rarely attend meetings? If yes, get concerned. It is so funny that people will accept Board appointments well aware that they already have enough on their plates. It is a human condition of greed. #9 Board members are involved in day-to-day management of the entity or organization. Any board member who gets involved in the day-to-day operations…

Understanding the concept of wealth

Small things mean a lot. The lack of financial literacy and good grasp of the concept of wealth is a big challenge to your personal financial independence and the economy at large. Even well educated people seem to lack basic wealth creation strategies. Below are some insights to unlock your wealth creation opportunities. Do you really understand the concept of wealth? Majority of people define wealth as owning a good car and a nice house. Wealth is defined in terms of having lots of money in the bank. People with debts are considered very poor. You must consider a cost…

Managing your taxes for maximum savings

Taxes matter a lot and you better plan for them. Also, you need to understand the difference between tax evasion and tax avoidance. Tax evasion is illegal failure to remit taxes while tax avoidance is legal. You need to plan your business and incomes to take advantage of tax avoidance schemes available. For example, income from your property is subjected to lower taxes than income from your stocks or salary that is usually charged at 30%. So, investing your savings in real estate appreciation may be a better strategy. As with all investments, you need to gather enough information and…

What is your opportunity cost?

Sylvester Kizito is one of those rare Ugandans who are very hard working. He has been through the furnace of life and seen it all. After completing senior six in one of the schools in rural Fort Portal, he was fortunate enough to get admitted to University on an evening program. Being self-sponsored, life has been very challenging. Around 2006, during his final year at campus, he applied and got accepted for internship at one of the banks as a teller. This was a turning point for him. Aware of his background, he started saving 40% of his monthly salary.…