You can buy a degree for many skills. But there is no shop for trust, credibility, and ethics. Every leader is constantly on the lookout for people they can trust, who are credible and have high levels of integrity. Can you keep secrets? Can you cover my back and I focus on what is in front of me without worrying about what you are doing behind my back? Can you stand in for me without worrying that you may become greedy? As an adviser to some of the top executives, once in a while, our firm wins a consulting project…

How to join the inner circle: top 3 qualities leaders crave

Every leader has two to five people in their inner circle. In big companies, the number of inner-circle confidants could total up to 10. Same with politicians. Any member in the inner circle is close to power, can influence decisions or deals. In many cases, ‘the official’ wife of the leader has significant influence over the boss, regardless of their level of education. That is the human condition. Followed by the members of the inner circle, like loyal cadres or folks who run the errands on behalf of the leader. Also, the children of the leader have some influence over…

Become a data literate professional

One of the easiest ways to test any auditor’s or consultant’s skills, is to overwhelm them with massive amounts of data. Once I was leading an investigation team in a highly populated African country at a utility company, with over 12m customers. Our firm had been hired to examine the possible mispricing since new connections were increasing without a corresponding increase in revenue. The issue was to examine the possible causes of increasing new customer acquisitions against stagnating revenues, despite the absence of any promotions or discounts. Many times, the client also wants to know who is responsible and how…

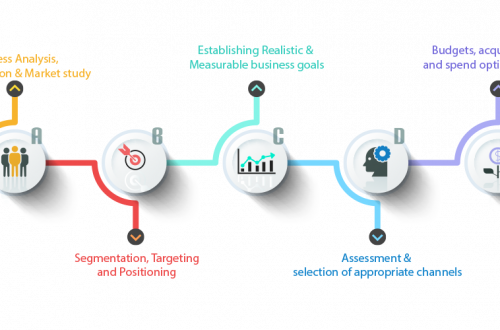

Automate your risk management processes

How would you answer the following questions? What keeps your leadership up at night? Do you experience challenges with strategy execution, risk management, and staff or strategy meetings? What is the risk to you? Who is responsible for risk identification, assessment, analysis, reporting, and on-going monitoring? Do you keep your risk register in MS Excel? How often do you update your risk register? How much does performance management processes cost your business? How do you know if your team’s everyday work is linked to the overall corporate strategy? Are your team’s everyday actions strategically aligned? Do you (or your team)…

Tips to be a great conversationist with leaders

It is that time of the year of more talk and less action. The politicians are competing in giving promises. The ear of a desperate man (and woman) will accept anything that gives hope. When you hear the same thing several times, you end up believing it! Many politicians know this. As a consultant, we are trained to talk. I used to think that when you get face time with the customer, you impress them by talking much to unleash your intellectual firepower. That is the wrong approach. To become a great conversationist you need to master the art of…

What is your mind drift? Here is what makes great leaders

A study was done to test the subtle qualities of great leadership. A conference room was filled with many people from all walks of life. The audience was informed that two groups of three different people were to address them. But they were not told about the profiles of the people and the message they were to deliver. “Just follow instructions”, they were told. The experimenter identified two groups of people – group A was composed of the most successful business leaders and entrepreneurs, and group B was made up of seasoned managers and frontline staff. These were told to…