In the old days, a blacksmith did not apply for work; he lit a fire. He showed the village his hammer, his scars, and the sword he forged last week. Today’s job applicant? They send a copy-pasted scroll, forged by ChatGPT, not fire. Last week I posted a job. Five days. 350 views. 321 applications. But here is the shock: I added a simple instruction at the end, answer a written question. Only 20 tried. Most skipped it. Those who did? They let ChatGPT do the talking. Not even an edit to show personality, insight, or hunger. Just default, lifeless…

What makes a 21st century board director?

At a recent closed-door review for a financial institution, a long-serving board member confidently asserted, “We’ve been through worse.” The room went silent. The comment, meant to reassure, exposed the core risk: legacy directors stuck in a pre-digital playbook while the business fights 21st-century fires with 20th-century tools. Modern boardrooms need a different DNA. The 21st-century board director is not a steward of stability but a strategist of disruption. Longevity on a board means nothing if it is not coupled with learning velocity. The following five traits now define director relevance: Agility under uncertainty – Directors must think in systems,…

What culture does your board tolerate?

In every boardroom I have walked into, in the public sector, financial institutions, or family-owned manufacturers, it only takes a few minutes of silence to smell the culture. Not read it, but smell it. At one board meeting, directors began as usual, heads down, scrolling through WhatsApp while nodding at the board pack. Midway through, the Chair paused and asked, “Has everyone read the strategy memo?” A few nodded. No one spoke. “Any concerns before we approve?” The room went quiet. “We trust management,” someone offered. But this was not trust. It was quiet disengagement disguised as confidence. Strategic detachment…

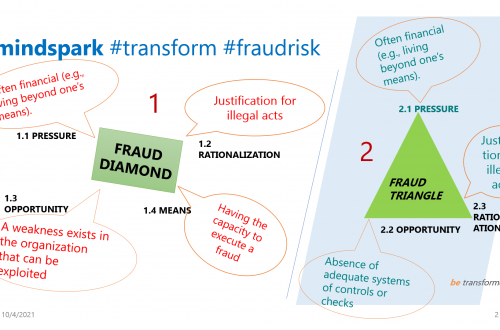

A fraud you do not investigate is a fraud you have approved

If your team can not detect fraud, you are not just exposed; you are endorsing theft with every passing day. From 2nd to 24th August 2025, step into the elite circle of fraud fighters. The Certified Fraud Examiner (CFE) program by the Institute of Forensics & ICT Security (IFIS) is not just another training but a battlefield upgrade. This is where auditors become warriors, where risk officers sharpen their sixth sense, and where compliance professionals become crime scene analysts. Master the full cycle: Detection: Know what most miss. Investigation: Follow money through cash, MoMo, crypto, and shell vendors. Resolution: Build…

Strategy is not a document; make it a habit, not a file

I once worked with a CEO who carried the strategy document like a Bible, only it never left his briefcase. It was during a quarterly strategy review. The boardroom was stiff with tension, directors shifting uncomfortably as the numbers were projected on the wall: missed revenue by 22%, customer churn up 18%, staff turnover at an all-time high. The CEO, unfazed, reached into his leather briefcase and pulled out the strategy document with a reverent smile. Thick, glossy, and laminated tabs. He opened it like a sacred scroll and began to read. “According to page 17 of our strategic priorities,…

Do human judgments still matter in this digital era in data analytics?

In chess, grandmasters still beat computers, but only when they break the rules. My team once trained a team of data analysts for a multinational bank. They had dashboards that blinked like Christmas trees, powered by AI and machine learning. Beautiful charts, predictive models, and Real-time sentiment analysis. Yet, they still failed to detect a UGX 3 billion fraud that a junior teller had flagged, based on “something just felt off.” That was the moment the CEO realized: data gives you signals, but only humans give them meaning. We are entering an era where algorithms tell you what is happening. But not why, not…