Outliers and many folks who have succeeded in their respective careers and professions are people who have self-drive, passion, and the right attitude when confronted with challenges. People who fail or lose opportunities usually have a bad attitude. They take things and events personally and fail to move past them. There is no great runner. There is a healthy person who dedicates his time to training harder. Puts in the time to go the extra mile. To wake up early and do something come rain come sunshine. Someone who is self-driven to achieve beyond the motivations their coaches or close…

Matrimony is a Permanent Marriage Union

Introduction Marriage is a serious and sacred commitment that puts man and a woman into a permanent and profound union. Marriage is a union between man and woman which is founded on love and free consent. This action has been raised to the dignity of sacrament meaning an outward sign of an inward grace instituted by God. A married couple is a visible sign and reminder that God loves us. Definition The sacrament of holy matrimony is a public vow between a mature male and female who promise to remain together until death. This loving union has been treasured by…

Your potential is not for sale

When I was working in Ernst & Young (EY), I always got offers for jobs from clients, prospects, and other top companies through headhunting. Some brands are so good that once you have them on your curriculum vitae, opportunities keep coming. EY is one such brand. At EY, you work with some of the best professionals as peers, managers, and partners. You spend a lot of your time with folks that have been outliers in their respective schools especially academically. Many people who join a firm like EY have a track record of success, and the staying power to see…

The leadership choices: are you winning?

#mindspark It’s tough to drive a car whose wheels are not aligned. You have to keep your hands on the steering wheel even on a straight road patch! See our Exchange when I invited a bank executive to attend our special Uganda banking report 2020 launch today at 10:00 am sharp. Me: It’s today at 10 am, make the time, and attend our report launch. Bank executive: Oh, I may miss. I have a meeting from 9:00 am to 4:00 pm. You will share the PPT slides. Me: Leadership is about choice. If the internal meetings, you do it regularly.…

Be careful with your local SACCO group

I joined a local community SACCO, with much excitement. But the monthly penalty charges of Ugx. 10,000 for not saving is becoming a problem. Saving culture is a good one. But saving is not enough. You must save and invest. Instead, SACCOs re-lend to other members at a favorable interest rate lower than commercial banks. It makes sense. At the start, many SACCOs by-laws and or constitution is poorly developed and there is lots of excitement. However, after a few months, things start changing. Folks who would save consistently, start skipping. And before you know it, the SACCO is running…

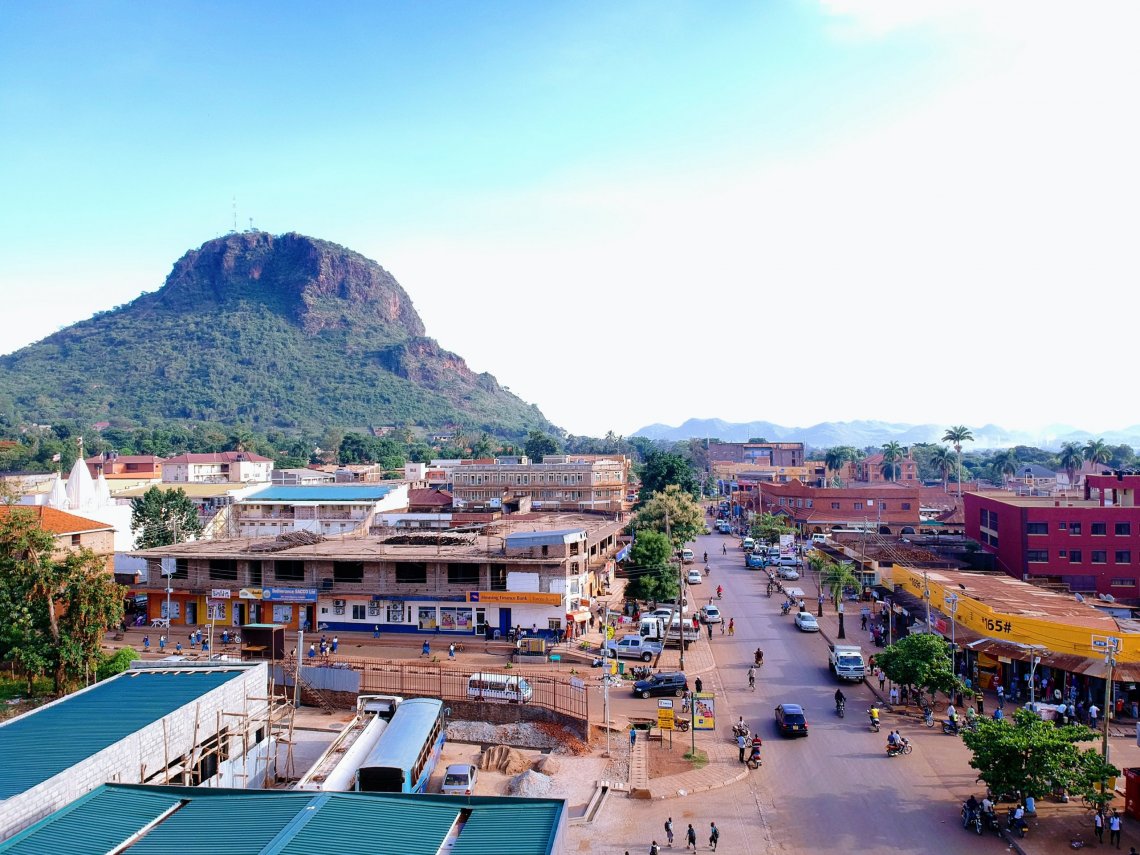

Policy, not laziness failing Ugandans

The biggest problem in Uganda is the tendency to recognize foreigners at the expense of locals who are educated. Makerere University (MAK) is a globally recognized institution ranked 9th in Africa. That is no mean achievement. Local Ugandans operate it and train so many people in the region every year. Some time back the Minister of State for Works was quoted during a conference as saying that “Ugandan contractors cannot undertake big road construction projects because they are incompetent.” Before making such a comment, one needs to understand that Ugandans are very competent and hardworking. The problem is they are…